Provider-Based Facilities and Split Billing: Is Your Facility Being Reimbursed for All Work Performed?

July 18th, 2018 - NAMASAre you stumped by billing guidelines for provider-based  facilities? Who bills for what and why? Read on to hear how a little extra time and effort spent on researching split billing coding guidelines can greatly impact your facility, and even your budget ensuring reimbursement for all services performed.

facilities? Who bills for what and why? Read on to hear how a little extra time and effort spent on researching split billing coding guidelines can greatly impact your facility, and even your budget ensuring reimbursement for all services performed.

facilities? Who bills for what and why? Read on to hear how a little extra time and effort spent on researching split billing coding guidelines can greatly impact your facility, and even your budget ensuring reimbursement for all services performed.

facilities? Who bills for what and why? Read on to hear how a little extra time and effort spent on researching split billing coding guidelines can greatly impact your facility, and even your budget ensuring reimbursement for all services performed. For those unfamiliar with provider-based departments, the provider-based designation was implemented by CMS offering the beneficiary important potential benefits such as increased beneficiary access and improvement in the quality of patient care by acknowledging the ownership and integration of the facility with a hospital system. This allows for facilities to bill Medicare as a facility at a higher rate of reimbursement to support the use of clinical staff, supplies and equipment.

To receive reimbursement for all potential services the charges are billed on two or more separate claims, one for the professional portion of the visit and another to support the facility piece for the supplies, overhead, as well as services provided by clinical staff. For services performed in provider-based facilities normally POS 19 or 22 is provided on the claim indicating the provider based designation. The professional claim is then submitted under the NPI of the attending physician, Medicare processes this claim using the Medicare professional fee schedule. As mentioned above, the services provided in these facilities are normally submitted on two or more claims. This process is most commonly referred to as split billing. The second claim is submitted with the facility charges and paid by Medicare using the OPPS (Hospital Outpatient Prospective Payment System). When the payments are combined, the payment is generally higher then what the practice could expect to receive as a free-standing facility.

A good example of split billing is stress testing. If the global procedure 93015 is submitted to Medicare on a 1500, for a provider-based department with a POS of 19 or 22 listed to support the split the 93015 will reject. The POS provided on the claim is going to determine if split billing is appropriate. The global procedure code supports all the different components of the stress test. This code would be appropriately billed by a single physician in a non-facility setting using their own equipment (e.g. POS 11). When provided in a facility setting (provider-based clinic e.g. 19 or 22), the different components warrant separate CPT codes to support the service rendered.

Global procedure 93015 cardiovascular stress test using maximal or submaximal treadmill or bike exercise, continuous electrocardiographic monitoring, and/or pharmacological stress; with supervision, interpretation and report.

Let's break this global code down to determine what may be appropriate for provider-based department.

Procedure 93016 supervision only, without interpretation and report. Keep in mind that even if an APP can perform the test based on scope of practice, they are not allowed to supervise due to Medicare rules.

Procedure 93017 tracing only, without interpretation and report (technical component to be provided on the AB).

Procedure 93018 interpretation of report only.

Ensure when split claim billing that the technical portion of the test is not overlooked. Also, procedures 93016 and 93018 may be provided by separate providers. Of note, the supervising physician and the interpreting physician do not need to be the same.

Be aware of what services are being provided by your department, ensure that all services provided are accounted for, and take the time to review the requirements. Do your research if you don't know the answers. In the following example you will see how assuming the answers can have a huge impact on a provider-based department. Medicare will not reject for services that are not accounted for, be your own advocate.

A few months back I received an email from a colleague wondering why their practice wasn't receiving reimbursement for pacemaker checks performed within the provider-based department. Upon further review I noticed that codes had not been provided for the facility piece of the pacemaker check. When I inquired with the group I was told that the facility did not own the pacemaker equipment, the equipment had been provided to the department by the pacemaker manufacturer. My first question to them was "who is performing the technical review?"

There are two possible answers to this question. First of all, if the technical review is being performed by a technician who has been provided by the pacemaker manufacturer, of course it would not be appropriate to bill. The only billing allowed for this scenario would be the services provided by the physician e.g. interrogation device evaluations (in person or remote).

There is a "rule of thumb" stating that if a site does not own the equipment then the service is non-billable. While this is often true in most cases, this scenario does not fit this specific situation. With that being said I would like to address the other possible answer. The technical review is being performed by a technician who works in the department and is funded by the facility. So now my question to you would be, who do you feel should be reimbursed for this service? Would it be the device manufacturer? The facility is utilizing the equipment but has an employed technician providing the review. Who reimburses them for the work performed? Does the manufacturer reimburse them? No.

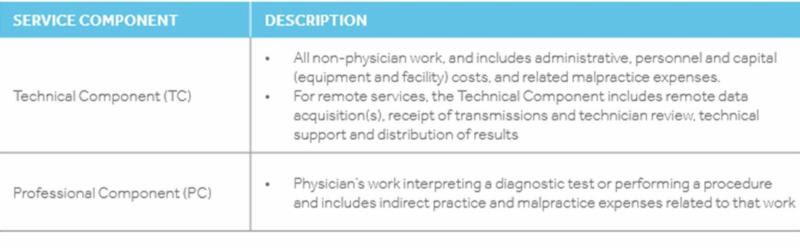

When a technician employed by the practice is performing the device checks it is absolutely appropriate for the technical component to be billed. Keep in mind that the facility charge not only supports the use of hospital equipment it also allows for reimbursement of overhead necessary for the operation of the clinic, supplies as well as services provided by clinical staff. The definitions below were provided by Medtronic, notice the technician review mentioned in the technical description.

I can't emphasize enough how important it is to think things through and be thorough. Consider different scenarios and ask questions. Just think, this department had been providing free services at the expense of their bottom line without any reimbursement to pay the technician. You have nothing to lose and lots of potential for gain.

###

Questions, comments?

If you have questions or comments about this article please contact us. Comments that provide additional related information may be added here by our Editors.

Latest articles: (any category)

Artificial Intelligence in Healthcare - A Medical Coder's PerspectiveDecember 26th, 2023 - Aimee Wilcox

We constantly hear how AI is creeping into every aspect of healthcare but what does that mean for medical coders and how can we better understand the language used in the codeset? Will AI take my place or will I learn with it and become an integral part of the process that uses AI to enhance my abilities?

Specialization: Your Advantage as a Medical Coding ContractorDecember 22nd, 2023 - Find-A-Code

Medical coding contractors offer a valuable service to healthcare providers who would rather outsource coding and billing rather than handling things in-house. Some contractors are better than others, but there is one thing they all have in common: the need to present some sort of value proposition in order to land new clients. As a contractor, your value proposition is the advantage you offer. And that advantage is specialization.

ICD-10-CM Coding of Chronic Obstructive Pulmonary Disease (COPD)December 19th, 2023 - Aimee Wilcox

Chronic respiratory disease is on the top 10 chronic disease list published by the National Institutes of Health (NIH). Although it is a chronic condition, it may be stable for some time and then suddenly become exacerbated and even impacted by another acute respiratory illness, such as bronchitis, RSV, or COVID-19. Understanding the nuances associated with the condition and how to properly assign ICD-10-CM codes is beneficial.

Changes to COVID-19 Vaccines Strike AgainDecember 12th, 2023 - Aimee Wilcox

According to the FDA, CDC, and other alphabet soup entities, the old COVID-19 vaccines are no longer able to treat the variants experienced today so new vaccines have been given the emergency use authorization to take the place of the old vaccines. No sooner was the updated 2024 CPT codebook published when 50 of the codes in it were deleted, some of which were being newly added for 2024.

Updated ICD-10-CM Codes for AppendicitisNovember 14th, 2023 - Aimee Wilcox

With approximately 250,000 cases of acute appendicitis diagnosed annually in the United States, coding updates were made to ensure high-specificity coding could be achieved when reporting these diagnoses. While appendicitis almost equally affects both men and women, the type of appendicitis varies, as dose the risk of infection, sepsis, and perforation.

COVID Vaccine Coding Changes as of November 1, 2023October 26th, 2023 - Wyn Staheli

COVID vaccine changes due to the end of the PHE as of November 1, 2023 are addressed in this article.

Medicare Guidance Changes for E/M ServicesOctober 11th, 2023 - Wyn Staheli

2023 brought quite a few changes to Evaluation and management (E/M) services. The significant revisions as noted in the CPT codebook were welcome changes to bring other E/M services more in line with the changes that took place with Office or Other Outpatient Services a few years ago. As part of CMS’ Medicare Learning Network, the “Evaluation and Management Services Guide” publication was finally updated as of August 2023 to include the changes that took place in 2023. If you take a look at the new publication (see references below),....